how much is the estate tax in texas

1 or as soon thereafter as. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Download Avalara sales tax rate tables by state or search tax rates by individual address.

. After deducting the 1206 million exemption for 2021 you have a taxable estate of 33 million. You also pay 40 of the. Ad Choose Avalara sales tax rate tables by state or look up individual rates by address.

Other Notable Taxes in Texas. Property Taxes in Texas Property. 1 2005 there is no estate tax in Texas.

Tax Code Section 3101 requires the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that persons agent by Oct. This marginal tax rate means. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that.

We dont make judgments or prescribe specific policies. Confused by the probate process. It is sometimes referred to as a death tax.

The exact property tax levied depends on the county in Texas the property is located in. See this related post on the differences between inheritance and estate tax. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Before the official 2022 Texas income tax rates are released provisional 2022 tax rates are based on Texas 2021 income tax brackets. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. 12000 from the propertys value.

See what makes us different. This percentage applies if you make more than 434550 for single. Texas has an oyster sales fee.

We make it as easy as possible. Your average tax rate is 1198 and your marginal tax rate is 22. The 2022 state personal income tax brackets are.

Counties in Texas collect an average of 181 of a propertys assesed fair. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Trust Will can help.

Texas has no inheritance tax so any money you. Estate and gift taxes the. In Texas property taxes are a major source of revenue for local governments.

1 2005 there is no estate tax in Texas. Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022. Texas Estate Tax.

The Estate Tax is a tax on your right to transfer property at your death. There is a 40. The initial payment for the first 1 million is 345800.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. How Much is Inheritance Tax in Texas. Shellfish dealers in Texas are.

Many of the states with the largest economies like California and Texas do have an estate or inheritance tax. A disabled veteran may also qualify for an exemption of 12000 of the assessed value of the property if the veteran is age 65 or older. How much is inheritance tax in Texas.

Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average. The state of Texas does not collect property taxes but each county has the option to tax property. State Tax Rate Estate Size.

If you make 70000 a year living in the region of Texas USA you will be taxed 8387. Ad Our easy-to-use Probate Software helps probate your estate without an expensive attorney. Also keep in mind that in the state of Texas the most you can be taxed is 20 percent on your home sale.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Estate Gift Tax Law San Antonio Texas

Why Republicans Want A Bigger U S Estate Tax Repeal Than Ever Bloomberg

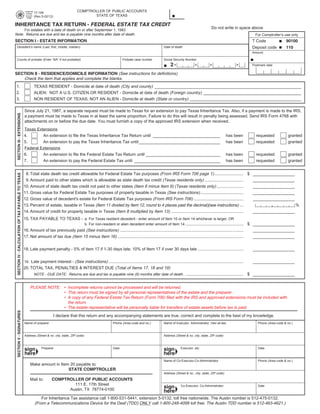

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Who Pays The Estate Tax Tax Policy Center

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Blog Pakis Giotes Page Burleson A Professional Corporation

Is There An Inheritance Tax In Texas

Is There An Estate Tax In Texas Dallas Estate Planning Attorneys

Texas A M Study Tax Code Changes Would Devastate Family Farms

2018 Estate Tax Changes Texas Agriculture Law

Senate Gop Tax Plan Promises More Deductions For Estate Tax Texas Farm Bureau

Texas Estate Tax Everything You Need To Know Massingill

The Estate Tax And Real Estate Eye On Housing